Developed by J. Welles Wilder Jr., RSI is a momentum oscillator that traders ultilise to measure speed of changes in price movements. Although regarded by many as a general trend indicator, it could also be used to generate relevant signals by watching out for divergences, failure swings and centerline crossovers.

Forex Trading with RSI

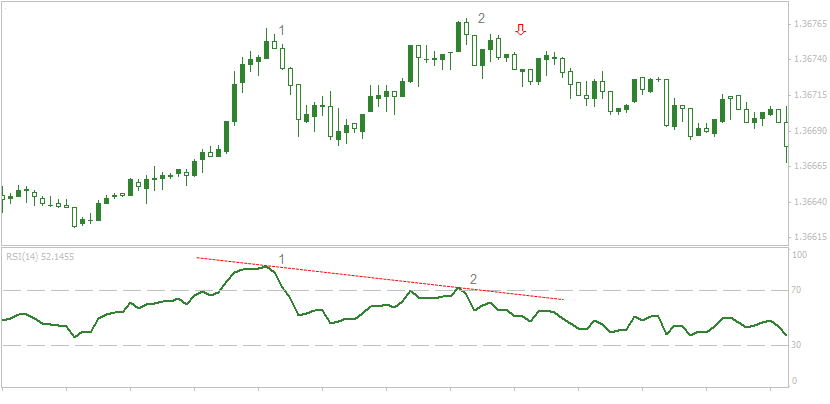

A bearish divergence exists when the prices make a new high while the RSI makes a lower high which means that it fails to confirm the high price. On the other hand, you have the bullish divergence where the price makes a new low but the RSI makes a higher low than the previous low, thus failing to confirm the low price.

The RSI is plotted on a vertical scale of 0 to 100 from the diagram above. Any movements above 70 region indicate an overbought pressure, while an oversold condition exists when it moves below 30 region. Usually any strong trend produces an extreme oscillator reading. So in such cases, just because the oscillator has moved above 70 region is not a reason to liquidate a long position or to enter a short position. This is just a first warning. You need to play a close look to the second move into the 70 zone. When the second move fails to confirm the price then a possible divergence exists.

Identifying Trends

Traders often use horizontal lines at the 70 and 30 values to generate buy and sell signals. Let’s assume you are looking for a buy opportunity. You watch your oscillator dip under 30 and it may develop a double bottom or some type of divergence within that region. A crossing back above the 30 region can be taken by you as a confirmation that the trend has turned by your oscillator and a buy signal is generated. This is one of the most popular oscillators among traders. In general lines, the RSI works best when its fluctuations reach the upper and lower extremes.

Conclusion

This tool does not seem to draw a higher percentage on precision and accuracy. Considering that Forex market by default will experience large surges and drops traceable from the aggressive demand and supply by buyers and sellers respectively. So in essence, to fully bring your analysis to a conclusion and take smart buying or selling decisions, you can compare the data from RSI and that from a few of your technical tools to have a comprehensive view of the true nature of the currency market.

Technical Indicators

Lessons in this section:

- Support and Resistance Lines

- Trendlines

- Channel Line

- Bollinger Bands

- The Relative Strength Index (RSI)

- Moving Averages